Good morning and welcome to Insider Finance. I'm Dan DeFrancesco, and here's what's on the agenda today:

- We spoke to 12 top fintech bankers about where their teams sit within the bank and the trends they are most excited about in the space.

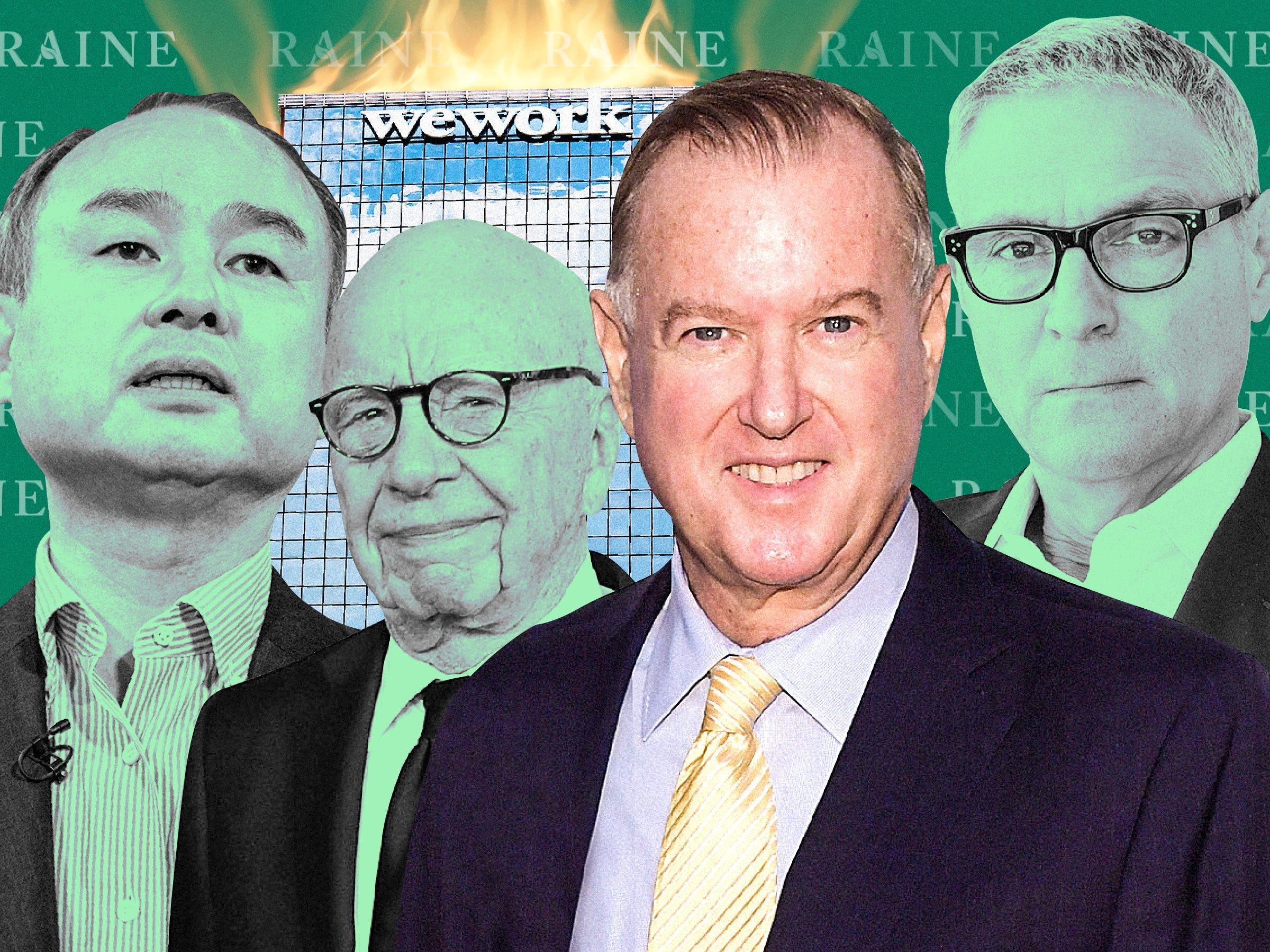

- How Jeff Sine built a career as a banker for corporate titans like Masayoshi Son and Rupert Murdoch.

- Credit Suisse loses yet another veteran credit trader, but nabs a top credit-trading exec from HSBC.

- Goldman Sachs and Wells Fargo both want to know their employees' vax status.

Like the newsletter? Hate the newsletter? Feel free to drop me a line at [email protected] or on Twitter @DanDeFrancesco.

12 top fintech bankers helping startups go public and make deals detail how they approach the sizzling market and the trends they're most excited about

Some of the industry's top fintech dealmakers gave us the scoop on the trends grabbing their attention.

The deal whisperer

Jeff Sine is an under-the-radar dealmaker who is quietly one of the most trusted advisors to SoftBank CEO Masayoshi Son, as well as other corporate titans like Rupert Murdoch and Ari Emanuel. Check out our profile on the unorthodox banker.

Credit Suisse has hired a credit-trading exec from HSBC after losing a whole team to the bank, as the battle over bond traders remains at a fever pitch

FABRICE COFFRINI/AFP/Getty Images)

Credit Suisse has nabbed HSBC's Truls Engebretsen as a senior credit trader in the latest update on the war for talent. Here's what we know.

Deutsche Bank hires a veteran credit trader from Credit Suisse as it looks to build momentum in investment-grade bonds

REUTERS/Luke MacGregor

Speaking of people moves in the credit space, Michael Lattarulo is on his way to the German lender. Find out more here.

Wells Fargo is confidentially surveying US employees about their vaccination status ahead of a broader return to office in September

Wells Fargo is asking employees to let the bank know if they've gotten the jab. Here's how, and why, the bank is collecting data.

Citi Ventures is poised to have its biggest year yet. Its global head details how the firm is tackling growing competition.

We sat down with Citi Ventures' Arvind Purushotham, who told us how the firm's strategy is evolving as a result of increased competition. Take a look at what else he said.

Hedge funds piled into the first-ever junk bond tied to bitcoin to avoid 'high-yield FOMO'

Software company MicroStrategy has raised $500 million in bonds that it will use to buy bitcoin. The deal, dubbed "hedge fund heavy," obtained about $1.6 billion in demand, and many hedge funds got in at the last minute to avoid feeling left out. Get the full rundown here.

Katapult is the latest fintech to go public during the buy now, pay later boom. CEO Orlando Zayas on how the pandemic fast-tracked the firm's plans despite him knowing zero about SPACs 9 months ago.

Zayas shared how Katapult has thrived during the pandemic - starting with accepting customers who were rejected by other lenders. Here's what he told us.

Goldman Sachs has asked US employees to report whether they've had a COVID-19 shot by midday today

It's mandatory for bankers to submit their vaccination status on an app, Goldman Sachs said in a memo seen by Insider. Here's what else the memo said.

Prolific cannabis investment firm Merida Capital is raising $250 million for a new fund. Managing partner Mitch Baruchowitz shares why he's betting big on medical cannabis and the 'normalization' of the industry.

Baruchowitz said the company is looking "to capture the largest component of cannabis' natural growth." Read more from our interview with the managing partner.

Odd lots:

Online Broker Webull Considers $400 Million U.S. IPO (Bloomberg)

Interactive Brokers to Offer Crypto Trading in Coming Months (Bloomberg)

Cryptocurrency Comes to Retirement Plans as Coinbase Teams Up With 401(k) Provider (WSJ)

Dit artikel is oorspronkelijk verschenen op z24.nl